The International Data Corportation (IDC) calculated that in 2010 the world created two zettabytes (ZB) of digital information. If, like me, you find this number too vast to envisage, it might help to learn that 2 ZB of data put onto 1 GB USB drives and laid out end to end, would stretch across 184 million football fields.

I thought this was impressive, until learning that the World Economic forum calculates that 45 ZB of digital information was created in 2020! This immense growth in data produced and collected is a dramatic outcome of the digital transformation businesses of all shapes and sizes have undergone in recent years. It seems that, in 2022, we really are living in a data-driven world.

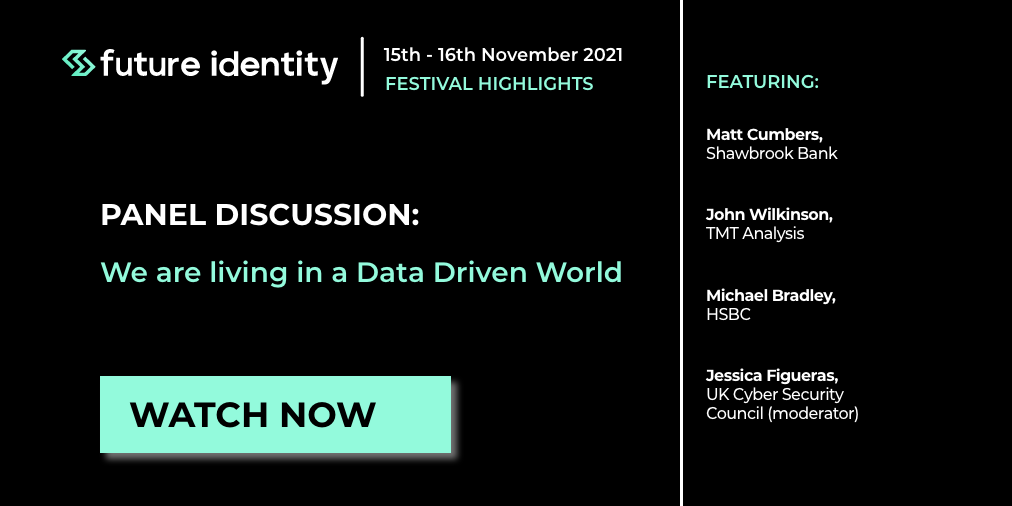

At the last Future Identity Festival, we were joined by panelists from HSBC, Shawbrook Bank, and TMT Analysis, all of whom have many years of experience using data in the context of digital identity, fraud prevention and compliance in financial services. They discussed the new types of data and methods of data sharing which have become available, and how these are being leveraged in the fight against financial crime.

Watch the full session now.

The conversation continues at Future Identity Finance 2022, on 26th April in London. Jessica Figueras will be moderating a discussion on the changing link between digital identity and cybersecurity in financial institutions. As CISOs continue to face rising breaches and cyber-attacks, is a shift to cybersecurity models centred around identity and authentication on the horizon?