How do businesses ensure that good customers have the most frictionless online authentication journey possible? How do businesses also ensure they are combatting fraud as much as possible?

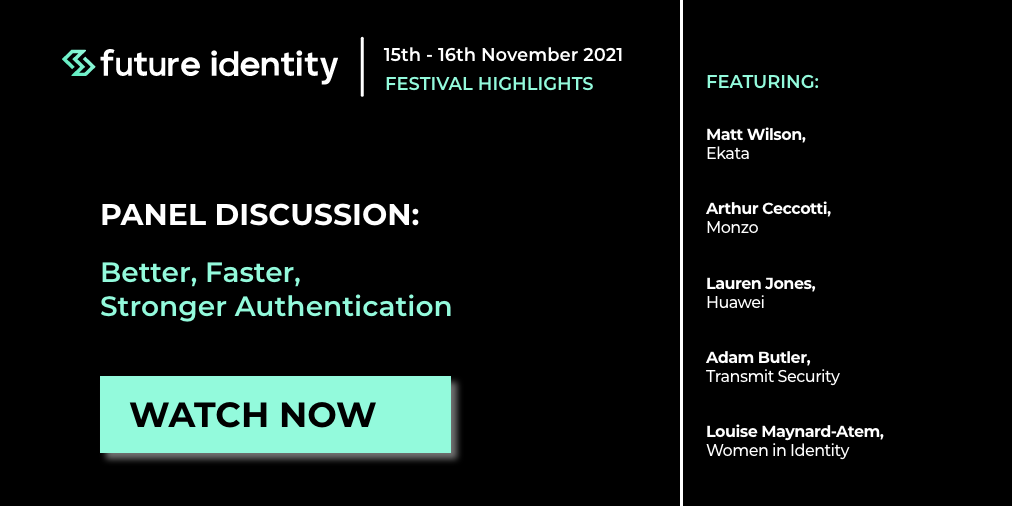

These are the questions Louise Maynard Atem, Research Lead at Women in Identity, sets out when introducing the panel discussion on ‘Better, Faster, Stronger Authentication’ at the Future Identity festival 2021.

Matt Wilson, Ekata, is first to address this tension between meeting customer expectations for a seamless online experience, whilst ensuring security remains a priority. “Technology is at the forefront of being able to make customer experience better, for everyone,” he stated, “but it could be our pitfall longer term from a fraud point of view.”

Go too far in favour of stringent authentication methods however, and a business risks losing customers – particularly from growing tech-savvy demographics. Arthur Ceccotti, Disputes Technical Lead at Monzo, points out that, “Across the industry there is a 20% abandonment rate, when you request SCA on an online payment,” so businesses have to balance the cost of fraud, against the cost of lost revenue.

Adam Butler, from Transmit Security, argues that today most businesses are either forced to prioritise experience at the detriment of security, or vice versa. “There is no balance between customer experience and security currently,” Adam notes, but he is optimistic about the future, as “the standards have been around for a while, and the manufacturers of devices like smartphones are starting to support those standards, which will enable a better future from a customer perspective and an organisational viewpoint.”

Lauren Jones, Huawei, also notes the importance of standardisation from groups such as Global Platform and FIDO, in driving improvements. However, Lauren also points out that throughout the Future Identity festival the topic of personalisation was discussed frequently, but never in the area of security. Interestingly Lauren points out that personalised security and authentication approaches, could enable greater financial inclusion because, “what I feel is secure may not be what others on the panel feel is secure.”

Watch the full session recording below.